AVERAGE GAS PRICES CLIMB AS TRANSITION TO SUMMER GASOLINE STARTS, DIESEL KEEPS FALLING

The nation’s average price of gasoline is back on the rise, climbing 3.5 cents from a week ago to $3.36 per gallon yesterday according to GasBuddy data compiled from more than 11 million individual price reports covering over 150,000 gas stations across the country. The national average is down 6.5 cents from a month ago and 69.3 cents per gallon lower than a year ago. The national average price of diesel fell 4.6 cents in the last week and stands at $4.34 per gallon, 26.8 cents lower than one year ago.

“The national average rose last week as the transition to summer gasoline has now started across the entire country. The higher cost of these various blends is being passed along to motorists, as we see every year ahead of the summer driving season,” said Patrick De Haan, head of petroleum analysis at GasBuddy. “Some regions are moving to the required summer gasoline in different steps then others, and the fragmentation of required blends absolutely plays a role in these price increases. Logistical challenges in making the transition during a time when refiners are also doing maintenance work can create hotspots and lead to noticeable jumps in prices during the spring. While we may not see weekly increases, the overall trend will remain upward through much of the spring. By Memorial Day, most of the nation will have transitioned to their respective required blend of fuel, and gas prices could ease, but a $4 per gallon national average remains possible by then.”

OIL PRICES

With China’s weaker than expected forecast for growth, oil prices opened the new week in the red, disappointed that demand from the country could be less than anticipated. In early trade, a barrel of West Texas Intermediate crude oil was down $1.04 per barrel to $78.64, still a $2+ rise from last Monday, partially from a weaker than expected rise in crude oil inventories and last week’s optimism of returning Chinese demand. Brent crude oil was down $1.22 in early trade to $84.61 per barrel, still a premium to last week’s $82.86 per barrel start. All eyes have been on China’s economy and consumption after the world’s second largest oil consuming country pushed aside its Covid-zero policy to reopen.

According to Baker Hughes, last week’s U.S. rig count was down 4 rigs to 749 but was 99 rigs higher than a year ago. The Canadian rig count rose 2 to 246 and was 29 rigs higher than a year ago.

OIL AND REFINED PRODUCTS

Last week’s report from the Energy Information Administration showed a smaller rise in crude oil inventories than analysts expected, rising 1.2 million barrels. Oil inventories now stand about 9% above the five year seasonal average, while the SPR remained unchanged, nearly 36% below its year ago level. Domestic crude oil production held at 12.3 million barrels per day, 700,000bpd higher than a year ago. Gasoline inventories fell 900,000 barrels as refiners purged winter-spec fuel, and every region has now started the move to summer blended fuels. Gasoline inventories now stand 5% below the five year seasonal average. Distillate inventories rose a meager 200,000 barrels, and stand 10% below the five year seasonal average. Refinery utilization rates fell 0.1 percentage point as maintenance season continues, with current rates of 85.8%. Gasoline production saw a rise to 9.7 million barrels per day while distillate production fell to 4.6 million barrels per day. Total oil stocks stand 103 million barrels higher than a year ago, but factoring in the SPR are 105 million barrels lower than a year ago. The U.S. saw a very high level of exports last week, amounting to sending some 77 million barrels of crude and refined products overseas, a record high.

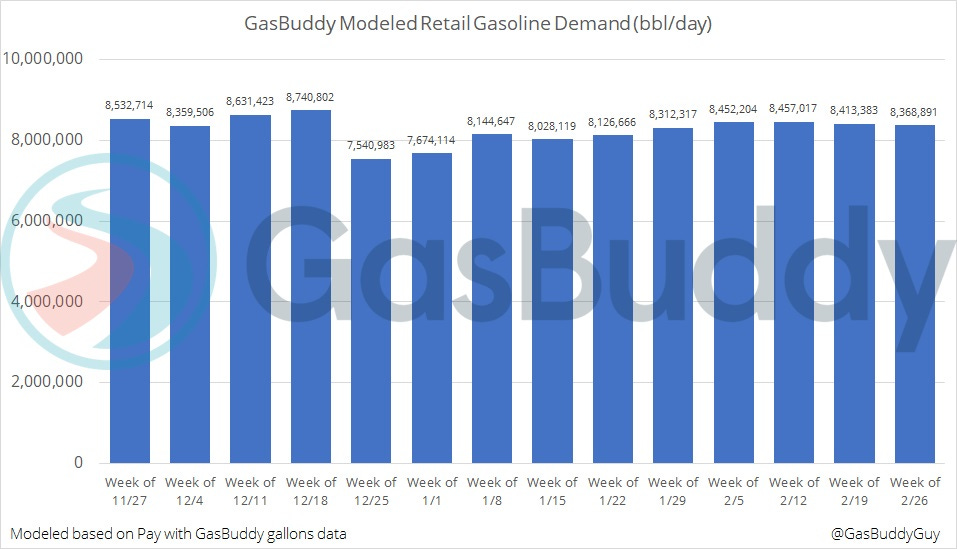

FUEL DEMAND

According to GasBuddy demand data driven by its Pay with GasBuddy fuel card, U.S. retail gasoline demand again fell 0.6% last week (Sun-Sat) as some winter weather again could have led to minor disruptions. Broken down by PADD region, demand rose 1.0% in PADD 1, fell 1.7% in PADD 2, fell 2.5% in PADD 3, rose 2.4% in PADD 4, and rose 0.2% in PADD 5.

GAS PRICE TRENDS

The most common U.S. gas price encountered by motorists stood at $2.99 per gallon, down 20 cents from last week, followed by $3.19, $3.09, $3.29, and $3.49 rounding out the top five most common prices.

The median U.S. gas price is $3.21 per gallon, up 2 cents from last week and about 15 cents lower than the national average.

The top 10% of stations in the country average $4.61 per gallon, while the bottom 10% average $2.84 per gallon.

The states with the lowest average prices: Mississippi ($2.92), Texas ($2.94), and Arkansas ($2.98).

The states with the highest average prices: California ($4.83), Hawaii ($4.78), and Nevada ($4.27).

DIESEL PRICE TRENDS

The most common U.S. diesel price stood at $3.99 per gallon, unchanged from last week, followed by $4.19, $4.29, $3.89, and $4.09 rounding out the top five most common prices.

The median U.S. diesel price is $4.23 per gallon, down 6 cents from last week and about 10 cents lower than the national average for diesel.

Diesel prices at the top 10% of stations in the country average $5.39 per gallon, while the bottom 10% average $3.64 per gallon.

The states with the lowest average diesel prices: Oklahoma ($3.79), Texas ($3.80), and Kansas ($3.92).

The states with the highest average diesel prices: Hawaii ($5.96), California ($5.57), and Maine ($5.25).